Lesson 1: Why is it important to invest?

Surely you have invested in the past, that is, you have put your resources to good use today:

- went to university and did self-development,

- bought a flat or a car for a comfortable life,

- invested time and attention in relationships with loved ones to be happy,

- were saving money for a deposit or investing in a business.

These are all serious investment decisions in which you have considered risks, allocated resources, and extracted returns.

Money is an important resource, it affects our lives

The source of money is employment or own business. According to statistics, in Europe the most favourable and active period for earning money is between the ages of 24 and 64. After that, the income drops and the person is no longer in demand. At this point he/she becomes the most vulnerable in terms of income.

In order to maintain a comfortable standard of living in your older age, you need to manage your money correctly today and build up a capital by retirement. In addition to a decent pension, a large sum of money may be needed for children's education, their first purchases in their adult life, and the purchase of real estate.

What happens to money that you don't spend today, but just save in a bank account or keep at home? It depreciates, you lose it, inflation eats it up.

Inflation is an increase in prices and a decrease in the purchasing power of money.

Due to inflation, the same amount of money can buy less and less goods and services every year.

Let's say you have 10,000 euros, you keep them at home, or they just lie idle in a bank account like a safe. Now imagine that they've been sitting like that for 10 years. All that time they've been eaten up by inflation. So technically, in 10 years you will have the same 10,000 euros, but you will be able to buy much less with them.

Post-pandemic inflation is rising around the world. In the Eurozone, it was 5.9 per cent in February 2022. Let's imagine that inflation will be the same in the next 10 years. What do you think your money will turn into?

This rate of inflation will eat up 43% of your money in 10 years: €10,000 will turn into €5,636.

Unfortunately, inflation is beyond our control, it depends on global economic factors. But we can take control of our resources: invest a little time and effort to make money work, defeat inflation and bring profit.

Investments will help to beat inflation and make money

The most conservative and understandable way to save money is a bank deposit. But deposit rates in Europe lowand some banks have negative interest rates. This means that you will have to pay to keep the money on deposit. This way of investing money and fighting inflation will not even allow you to just keep your savings. Over the years, you will not only lose some of the value of the money, but you will also miss out on the opportunity to earn money.

Investing in the stock market allows you to get higher returns than a deposit. For example, from 1991 to 2021, the main stock exchange instruments for investment yielded the following returns:

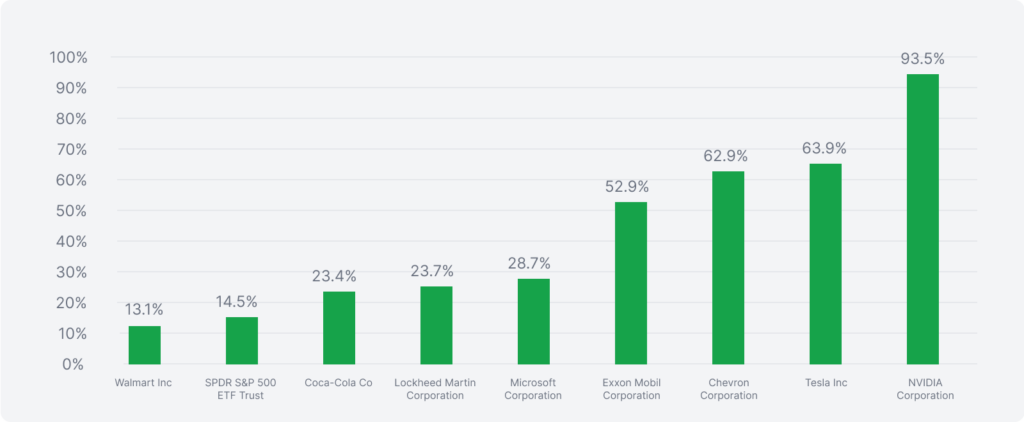

And this is how the most popular stocks rose between 01.04.21 and 01.04.22:

The magic of compound interest increases investment

Historical stock return results are impressive, but you can earn even more if:

- invest money on a regular rather than a one-off basis. For example, save and invest an additional small amount of money once a month,

- the interest received from investments is re-invested in securities, i.e. reinvested. The money is not withdrawn, but always works, and interest accrues on the previous interest. This is called the magic of compound interest, such interest accelerates the growth of your savings and investments over time.

Let's go back to your 10,000 euros that have been sitting around for 10 years, eaten up by inflation and depreciated in value. Let's do something else with them: invest the money in US stocks to build up your pension, educate your children or make other big expenditures in the future.

Let's assume that the return on U.S. stocks has remained the same - about 8% per annum, although the past performance of investment instruments does not guarantee their return in the future. Let's use the magic of compound interest, i.e. we will not withdraw the interim profit, but reinvest it in securities. As a result, in 10 years you will receive 21,589 euros, i.e. even taking into account high inflation you will earn a profit and the money will not lose its purchasing power.

Ahead of you is a short and engaging course where we will tell you:

- exactly how to make money on investments,

- what to invest in and how to invest in it,

- How to build and manage your portfolio.

How it works. You register for the course, study the lessons and take the tests. We award you points for correct answers, and at the end we will calculate everything and determine how successful you are as an investor.